Almacenamos pequeños archivos de datos llamados cookies para ayudarnos a entender cómo interactúas con nuestro sitio. Puedes decidir qué tipos de información estás dispuesto a compartir. Consulta nuestros detalles completos sobre cookies si quieres más información.

Las Finanzas se Encuentran con la Estrategia Creativa

Enseñamos a los dueños de negocios cómo leer sus números con claridad y construir sistemas financieros que realmente apoyen el crecimiento creativo. Comienza en septiembre de 2025.

Explora los Detalles del Programa

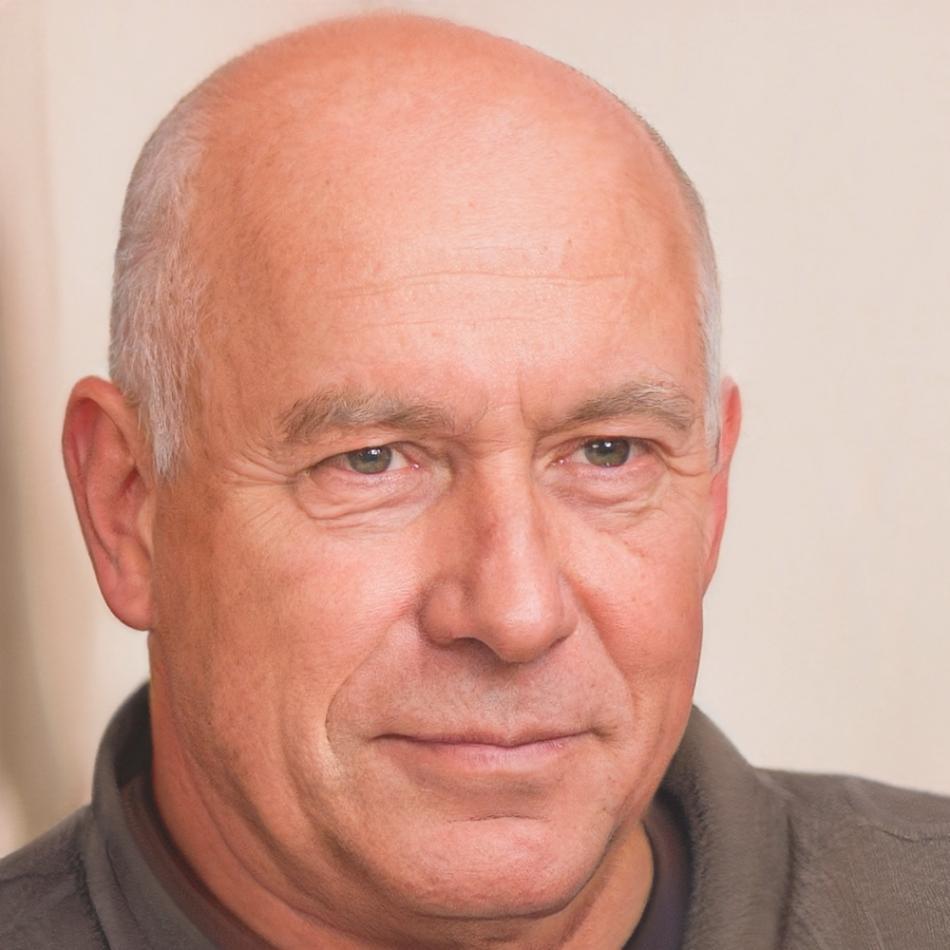

Aprende de Alguien que lo Entiende

Theron Mulgrave ha pasado quince años ayudando a negocios creativos a entender sus finanzas. Ha trabajado con estudios de diseño, editoriales independientes y pequeñas productoras en toda Málaga. Su enfoque es directo: sin jerga, sin teorías que suenen bien pero no funcionen en la práctica.

Antes de enseñar, Theron gestionó las finanzas de tres agencias creativas diferentes. Sabe lo que es cuando el flujo de caja no coincide con el calendario de proyectos, o cuando necesitas explicar tus números a alguien que solo habla hojas de cálculo.

Su estilo de enseñanza se centra en escenarios reales. Trabajarás con situaciones empresariales reales: fijación de precios de proyectos, previsión de ingresos durante meses lentos, configuración de sistemas que no requieren un contable a tiempo completo.

Cómo es el Camino de Aprendizaje

Nuestro programa de ocho meses se extiende desde septiembre de 2025 hasta abril de 2026. Está diseñado para personas que dirigen negocios, no para estudiar teoría.

01

Fase de Fundamentos

Comenzamos entendiendo tu situación financiera actual. ¿Qué sistemas estás utilizando? ¿Dónde están las lagunas? Esta fase trata de evaluación, no de juicio. Aprenderás a leer tus estados financieros sin pánico.

02

Construcción de Sistemas

Aquí configuramos procesos que funcionan para negocios creativos. Seguimiento de costos de proyectos, gestión de ingresos irregulares, creación de previsiones que reflejen el ritmo real de tu negocio. Todo se prueba con tus números reales.

03

Período de Aplicación

Pasarás tres meses aplicando lo aprendido mientras Theron revisa tu progreso. Las revisiones mensuales ayudan a ajustar los sistemas según sea necesario. La mayoría de los participantes descubren problemas que no sabían que existían, ese es el objetivo.

Proyectos Reales, Números Reales

Cada sesión incluye el análisis de situaciones empresariales reales. Hemos examinado estrategias de fijación de precios para agencias digitales, gestión de flujo de caja para trabajos creativos estacionales y planificación financiera para negocios con cronogramas de proyectos impredecibles.

Un análisis reciente examinó un estudio de diseño gráfico que era rentable en papel pero siempre estaba corto de efectivo. Rastreamos su línea de tiempo de facturación, términos de pago y programación de gastos. El problema no era los ingresos, era el momento.

Ejemplo de la Última Cohorte

Una empresa de producción de contenido se dio cuenta de que su fijación de precios no tenía en cuenta los ciclos de revisión. Tras reconstruir su proceso de estimación, ajustaron las tarifas en un dieciocho por ciento y mejoraron los márgenes de beneficio sin perder clientes. La clave fue mostrar valor, no solo aumentar los precios.

Preguntas que la Gente Realmente Hace

Estas provienen de conversaciones con dueños de negocios que consideran el programa. Si tienes alguna duda que no esté cubierta aquí, envíanos un mensaje.

Antes de Unirte

¿Necesito conocimientos de contabilidad?

Para nada. La mayoría de los participantes tienen antecedentes creativos o técnicos. Enseñamos los conceptos financieros que realmente necesitas, no todo lo que existe.

¿Y si mi negocio es nuevo?

El programa funciona mejor si has estado operando durante al menos seis meses. Necesitas algo de historial financiero para trabajar, aunque esté desordenado.

¿Cuánto tiempo requiere semanalmente?

Planea seis horas: tres para sesiones, tres para aplicar conceptos a tu negocio. Algunas semanas requieren más, especialmente durante la fase de construcción de sistemas.

Durante el Programa

¿Qué pasa si me atraso en las tareas?

Incorporamos tiempo de recuperación. El cronograma tiene en cuenta los períodos ocupados de tu negocio. Dicho esto, la participación constante es más importante que la finalización perfecta.

¿Puedo obtener ayuda entre sesiones?

Sí. Se incluye soporte por correo electrónico, con respuestas generalmente en 48 horas. Para preguntas urgentes durante la fase de aplicación, programamos llamadas breves.

¿Mi información empresarial permanecerá privada?

Absolutamente. Cuando discutimos ejemplos en sesiones grupales, se eliminan todos los detalles identificativos. Tus datos financieros reales solo se revisan en consultas privadas.